Post originally written by @AndyKhalil1 on twitter

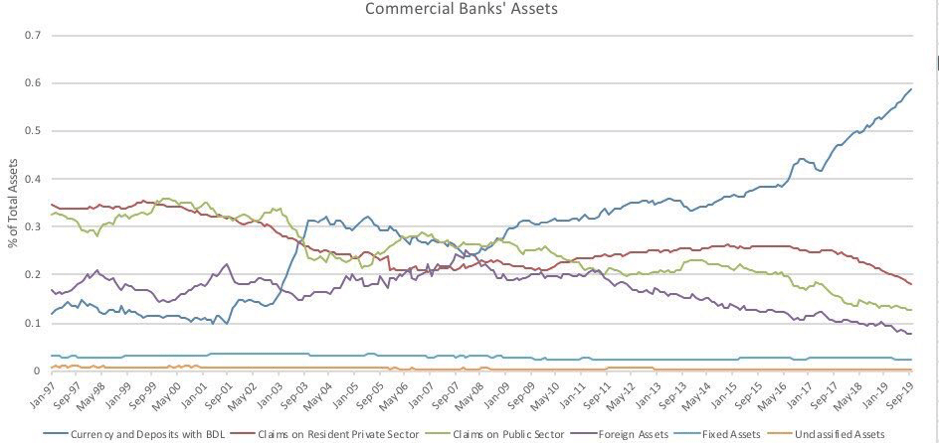

Below are banks’ assets expressed as a share in total assets. Note the acceleration in the share of deposits at BDL &the reduction in that of all other variables, especially post 2016 when FE (Financial Engineering) commenced. Where is the efficient financial intermediation & allocation of capital?

Source: BDL

Notice how the $ BRR (Beirut Reference Rate), the benchmark banks use to determine the interest rate they charge on $ loans, accelerated throughout the same period. This greatly impedes the private sector’s ability to invest in the economy and tremendously inflates the cost of its existing debt.

“Currency and deposits with BDL tell the story” – @HuseinNourdin

In monetary economics when these expand at this rate and to this level. It is quantitative evidence of a Ponzi scheme on reserves, which is equivalent to the insolvency of the central bank. Fiscal support would hinder this but our government is also running a huge deficit. – Andy

“an increased fiscal deficit can be tolerated had it not been for the foreign debt in Eurobonds where they need to come up with real dollars to meet maturities of foreign held paper” – @NabilKurd

Tolerated yes but it also impedes the government’s ability to subsidize the central bank when it suffers from negative net income and net worth. – Andy

“No subsidies to the CB. In fact the CB will keep on printing to bail out the government for next month’s state salaries & exp and for the foreseeable future” – @NabilKurd

Hence the inevitable insolvency of both – Andy