Post written by @RosalieBerthier

The official fixed rate of the Lebanese pound against the dollar is central to the country’s crumbling social compact. It is one aspect of the system most people would prefer to keep, although it feeds into everything they are eager to get rid of.

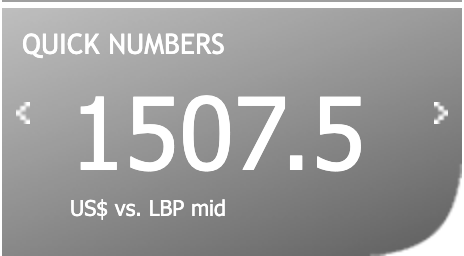

Nominally, the rate remains unchanged at 1507,5 LBP per USD. State agencies and commercial banks still use this standard, established in 1997 and known as “the peg”, as do many businesses that have yet to adjust to creeping inflation on the exchange market.

Screenshot from BDL’s website

In a rare consensus, various Lebanese officials and activists defend the peg because it boosts and stabilizes the pound. It guarantees people’s savings and subsidizes key imports such as flour, fuel, and medicine—in effect, protecting ordinary Lebanese. But the pound is already floating against the dollar in ways that deepen dangerous inequalities: The wealthy enjoy easier access to hard currency—in Lebanon and abroad—while the most vulnerable see their savings and income in pounds plummet.

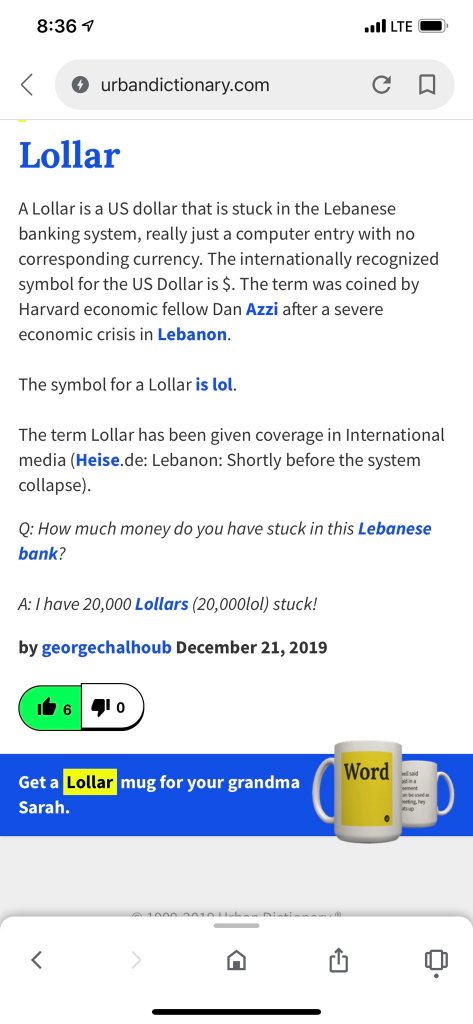

The problem is that the floating rate is irreversible. Denying its reality—like the Lebanese president, who wants to sue anyone who reports “bad news” regarding the pound—only prevents the formulation of an alternative safety net policy. A fixed rate cannot be maintained. Clamping down on foreign exchange companies (as some Lebanese advocate) would create a shadier black market, because the state and the banks don’t have the liquidity in dollars to meet demand at their own official rate. Worse, they are hoovering up all available dollars to repay interests on the sovereign debt, provide liquidity to rich clients, and fund crucial imports. They are making dollars even rarer and more valuable—thus weakening the pound they claim to defend.

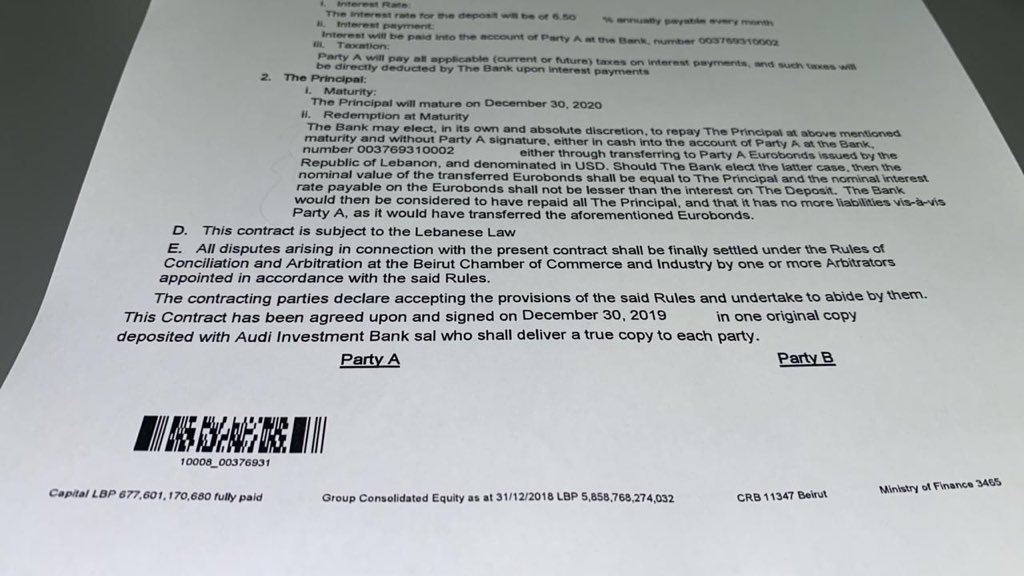

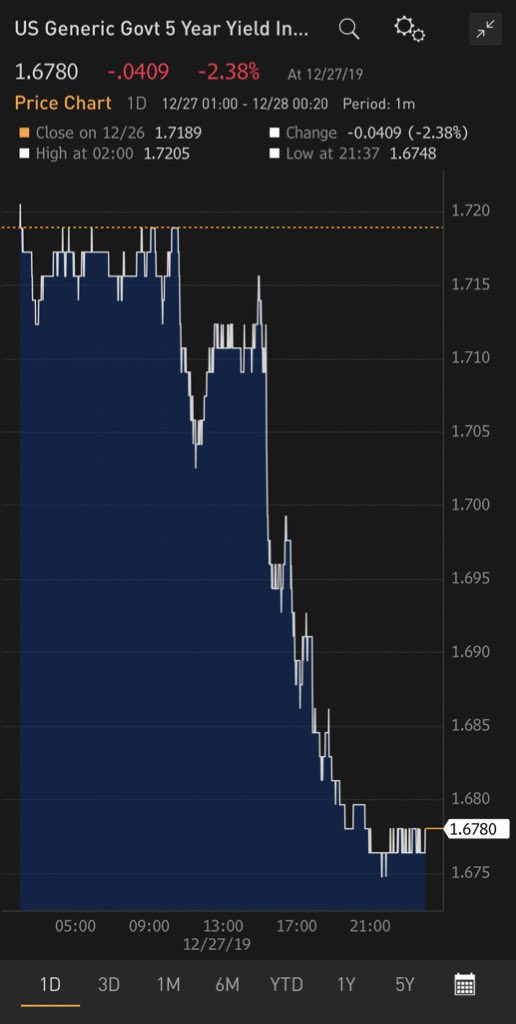

The only way the system has found to uphold the peg is to make banks withhold both dollars and pounds, to reduce liquidity in the market and therefore the volume of exchange transactions. The side-effects have crippled consumption, trade, and salaries. At the best of times, sustaining the peg was costly to the country as a whole. Keeping the parity between LBP and USD, despite a massive trade deficit, required dodgy schemes to attract dollars—notably speculative investments in the spiralling sovereign debt.

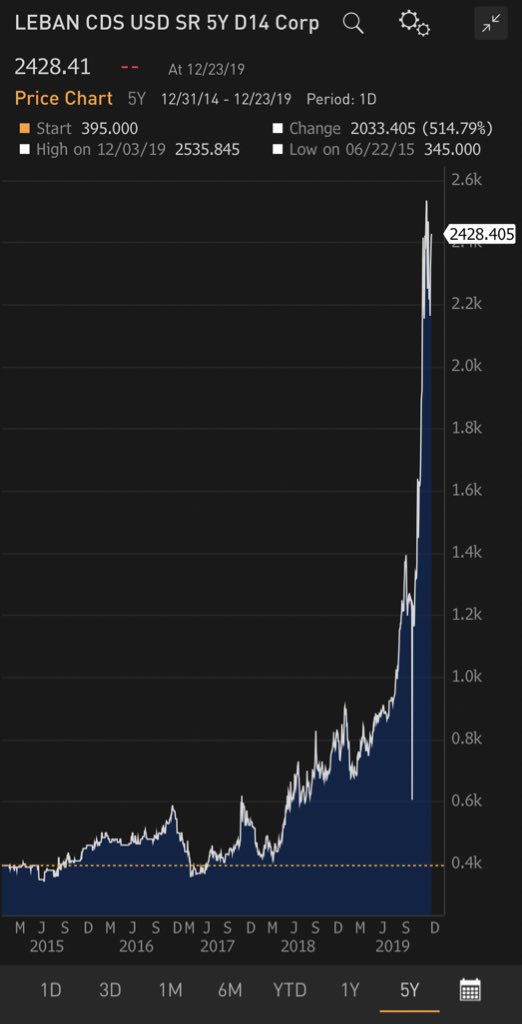

The peg thus inflated a national debt that is borne by every Lebanese, while rewarding the largest investors with flabbergasting returns. Meanwhile, it subsidized not just medicine, but luxury goods as well as basic imports that undermined local products This system robbed Lebanon of a productive economy. The peg made parking money in banks far more lucrative than anything else. The state itself borrowed not to invest but to pay back loans, retain investor confidence, and keep the whole scheme running. The peg also bought the peace—allowing everyone to enjoy artificially high living standards and interest rates, making up for low salaries, rare job opportunities, and worsening public services. Without the peg, social unrest would have manifested earlier That said, the peg had become unsustainable before the uprising started. Signs of stress multiplied in recent years, as sources of dollars shrunk (exports, tourism, and remittances), while repayments on a snowballing debt required ever more financial engineering

Long before the first protests, the banks introduced caps on dollar withdrawals and failed to provide the hard currency to import fuel, prompting petrol stations to go on strike. These mini-crises fed the general malaise that came to a head this fall. The crux of the current turmoil revolves around the end of an economic system that, for all its flaws, also made life more bearable for many struggling Lebanese. No one knows what will happen when people realize that the little they had is now gone. The peg hid the country’s gradual impoverishment—now revealed & catalyzed by the floating pound. All the more reason to discuss pragmatically what must be done—not to preserve a system rotten to the core but to sow the seeds of a new one

- The first concern is to guarantee essential imports in ways that protect the neediest. For now, even the rich buy subsidized bread and electricity. Meanwhile, meds and fuel could quickly become unaffordable to the most vulnerable—calling for targeted subsidies.

- The second priority is a safety net for employees paid in LBP and pensioners whose life-savings will be wiped out: State reserves or foreign funding must serve to prevent them from falling into deep poverty, through the creation of a guaranteed minimum income.

- The third, longer-term goal is to shift from imports and unproductive investments to local produce, better infrastructure, an SME-friendly legal framework, and fair taxation. Lebanon has loaded its youth with debt; any further spending must now invest in its future.