Post originally written by @lebfinance on twitter.

I heard some “experts” quoting the CDS levels on many occasions without explaining what they are. What is a CDS and why is it very important? (VERY SIMPLIFIED)

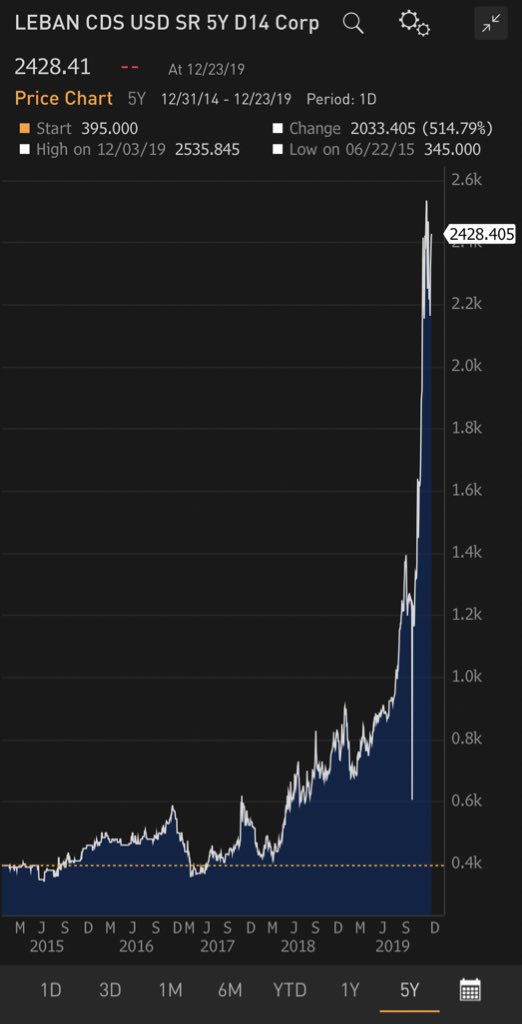

Basically “Credit Default Swaps” are a derivative instrument that trades and are usually used to hedge (insurance) ur bonds. When you buy a CDS and buy the underlying bond you are “hedged”. It is quoted in basis points so CDS at 2,428bps is 24.28%.

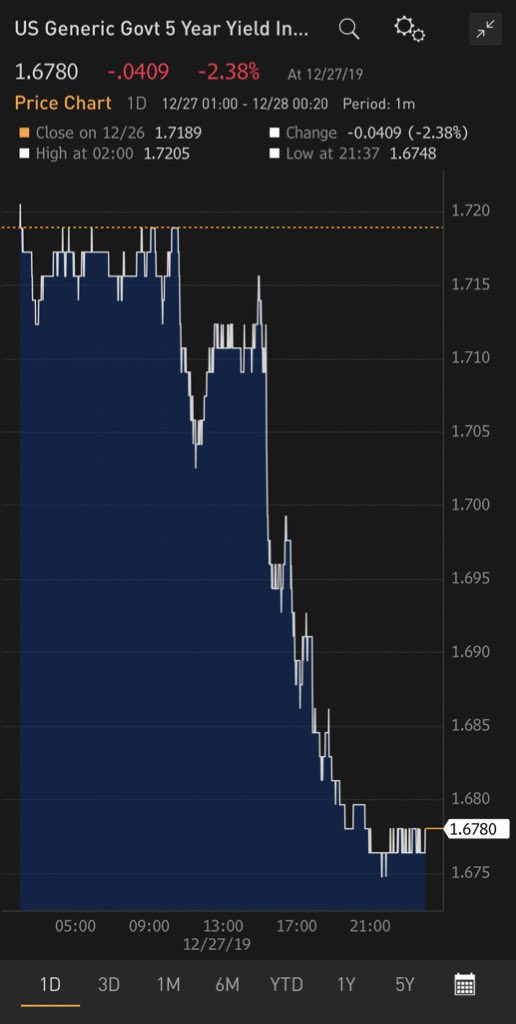

Simply put, it means that when LEBANON wants to issue bonds for 5y to the market, the market is pricing a spread of 24.28% above the risk free rate, in this case the $ US treasuries (or US swaps) 1.64%.

So if the MOF wants to issue today they need to pay 24%+1.64%=25.64%, which is very expensive and not sustainable. Imagine paying 25% interest on ur debt. This is where the current 5y bond is trading 25.63%. So spot on.

This is highly simplified and not applicable now. Markets are too illiquid and even at 40% yield the MOF won’t be able to issue because nobody will buy the bonds at a price of 100. Recovery value is a lot lower.

p.s. Lebfinance is aware that we should trade in points upfront, he was just explaining CDS in simplified terms to make the concept a bit easier to understand.