This was shared today on twitter:

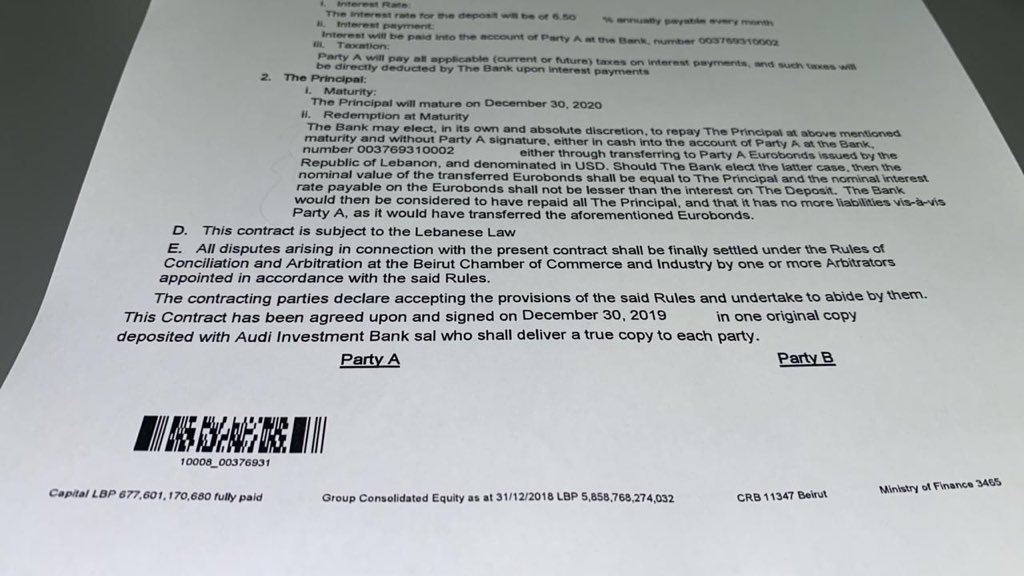

This is on the maturity date of a savings account, and bank Audi has drafted a new contract which seems to give the person two options: Renew or take Eurobonds.

Should we take Eurobonds?

@ladGeorges shares some info:

Best option is to take Eurobonds at current market date. This is a good deal. By forcing people to take Eurobonds they are passing on the upcoming losses from assets to depositors without touching the equity. And the “ponzi” continues.

But there is a legal case against the bank: offering a new financial instrument called “Eurobonds or deposit” is akin to a new derivative product.

- cannot be sold to any individual before a suitability assessment is made

- CMA is supposed to have vetted this new product

BDL (Banque du Liban) and CMA (Capital Market Authority) must clear it. If reported to them and they fail to act they are liable for the depositors’ losses. If it is not reported to them, the bank is liable for the losses and for breach of regulatory requirements.

Eurobonds are rated CCC! Your bank is forcing upon you CCC rated paper it holds. You also have 2 Legal claims:

- Selling CCC paper to individual investors is legally reprehensible

- Eurobonds trading at 50 and sold at par is a financial crime

- These are Eurobonds already held by Audi, i.e. the bank is in flagrant conflict of interest

Is this a risk?

For example, if you buy them at 50. Come March you cash 100. This is akin to 400% annualized. Your downside is a default. And historical pattern for Eurobonds is a 35 cents recovery. So you would have lost 15. Better than expected outcome than any other investment in Lebanon.